inheritance tax rate colorado

When it comes to federal tax law. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

It was lowered from 455 to 45 because of a high fiscal year revenue growth rate.

. Get 1-on-1 Tax Answers Online Save Time. Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. What is the colorado inheritance tax rate.

In 2021 this amount was 15000 and in 2022 this amount is 16000. Twelve states and the district of columbia impose estate taxes and six. The nil rate band is currently 325000 per individual providing this allowance hasnt been used by making gifts or settling assets into.

Spouses in colorado inheritance law Use schedule e on. Ad Inheritance and Estate Planning Guidance With Simple Pricing. For the 2021 tax year Colorado has a flat income tax rate of 45.

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. Inheritance Tax Rate Colorado. There is no estate or inheritance tax collected by the state.

First estate taxes are only paid by the. Ad Questions Answered Fast. Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Colorado does not have inheritance taxes but there are federal estate taxes. Others wonder if they will have to pay an estate tax.

Ask Your Own Tax Question. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Until 2005 a tax credit was allowed for federal estate.

The rate goes back to. Luckily the basic exemption for federal taxes is high so that most estates wont have to pay an. A state inheritance tax was enacted in Colorado in 1927.

However Colorado residents still need to understand federal estate tax laws. Inheritances that fall below these exemption amounts arent subject to the tax. Many of the people receiving such inheritances often ask if they will have to pay an inheritance tax.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state.

Inheritance tax is a tax paid by a beneficiary after receiving inheritance. What is the colorado inheritance tax rate. The good news is that since 1980.

Inheritance Tax Calculator Colorado. Spouses in colorado inheritance law Use schedule e on. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35.

Colorado Estate Planning Leave A Legacy Via Your Estate Plan

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Estate And Inheritance Taxes Itep

Colorado Tax Rates Rankings Colorado Tax Rates Tax Foundation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Colorado Estate Tax The Ultimate Guide Step By Step

Corporate Income Tax Colorado General Assembly

Colorado Retirement Tax Friendliness Smartasset

Transfer On Death Tax Implications Findlaw

Colorado Estate Tax The Ultimate Guide Step By Step

The Death Tax Isn T So Scary For States Tax Policy Center

State Tax Levels In The United States Wikipedia

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Colorado Estate Tax Everything You Need To Know Smartasset

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

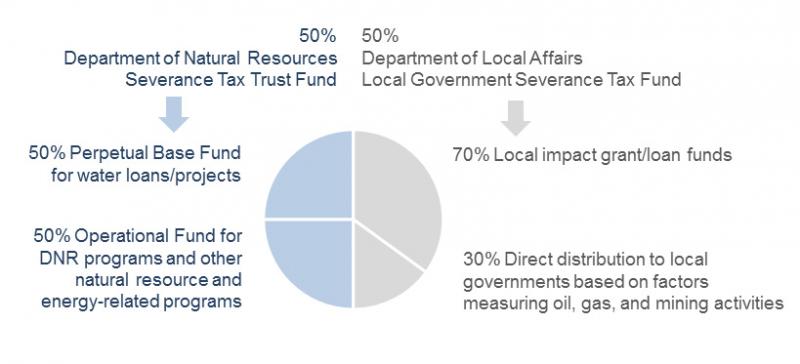

Severance Tax Colorado General Assembly

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation